Every week, I roll into the supermarket, my trusty shopping list clutched in hand, ready for the usual chore. But when I check my bank balance at the end of the month, I often wonder: where did all my money go? The mundane act of grocery shopping feels the same, yet my budget tells a different story. Spoiler alert—it’s not just about what I’m buying; it’s about how I’m shopping.

Highlights

- Missing a Written List: Shopping without a clear plan can lead to impulse buys.

- Impulse Purchases: Those “little extras” add up quickly to significant sums.

- Emotional Timing: Shopping when hungry or tired increases spending.

- Real Savings: Switching to a structured list can save 10-25% on monthly grocery bills.

This quiet inflation of my grocery budget often starts at the entrance of the store. What I’ve discovered is that the absence of a precise, written list is usually the culprit. I used to think a mental list would suffice. “I just need a few things,” I’d say. Yet, without that anchor, my shopping cart transforms into a reflection of impulse decisions fueled by hunger and marketing allure.

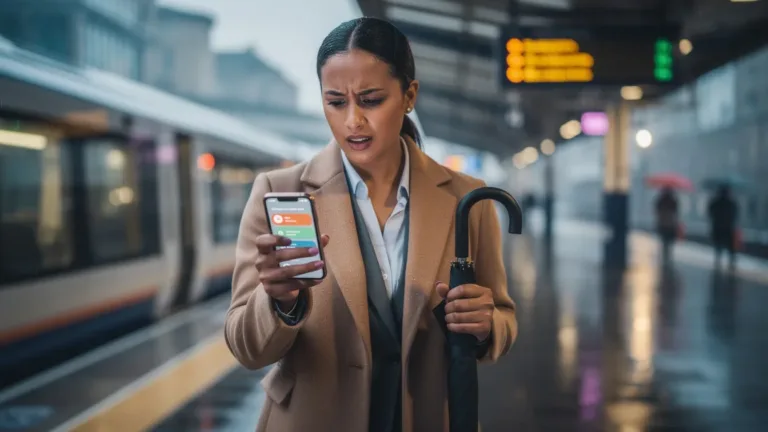

Picture this: it’s Thursday evening, I’m exhausted, and I stroll into the shop “just for bread and milk.” A whiff of fresh croissants wafts through the air, and suddenly, I’m tossing treats into my basket. By the time I reach the checkout, I’ve accumulated a pile of items that weren’t even on my radar—three times what I intended to spend. A classic case of supermarket strategy where lack of planning leads to overspending.

The Silent Budget Leak Hiding in Plain Sight

Have you ever considered why your grocery bill keeps creeping up? Most people often believe it’s about prices or brands. In reality, the critical factor is the habits we form before we even select our items. Supermarkets expertly play on this notion of “shopping without a list,” exploiting every emotional and sensory cue within reach. It’s not just a shopping trip; it’s a testing ground for your willpower against cleverly marketed temptations.

To regain control, I had to treat my list as more than just a formality. It became my shopping strategy, my spending limit in disguise. I found that when I generated a focused list at home, using it as a tactical tool for navigating the aisles, my spending took a nosedive. I realized I needed to ask myself: what do I genuinely need for my meals this week? The answer tends to refocus not just my list but my spending habits as a whole.

Transforming Your Shopping Experience

The ultimate goal was not just to have a list but to clarify the mission behind it. I began by grouping my items into zones—fresh produce, dry goods, and household essentials. This structure resembles a GPS, guiding me through the labyrinth of supermarket aisles. Instead of aimlessly wandering, I entered with precision and purpose.

- Keep a shared list on your phone, allowing everyone at home to contribute. 📲

- Before shopping, clean up the clutter on your list, sorting by aisle to streamline your trip. 🛒

- Decide on a small “freedom budget” for spontaneous treats without breaking the bank. 💸

This approach transformed my shopping trips from chaotic excursions to focused missions. It feels liberating to be strategic rather than reactive. Over time, I noticed significant savings of 10-25% without sacrificing the quality of the food I purchased. That’s when I understood: it’s not about taking the fun out of shopping; it’s about ensuring that I can enjoy spontaneity without financial remorse.

Smart Strategies for Lasting Change

One vital trick I learned along the way is the art of emotional timing. I realised that shopping when I felt rushed, stressed, or hungry could unravel the most meticulously crafted list. So, I now schedule my grocery trips during calm moments, ensuring I remain fully engaged with my mission. It may seem ordinary, but this simple change makes all the difference when it comes to sticking to my budget.

Of course, some days I still find myself succumbing to impulse—a chocolate bar here, a fancy cheese there—little indulgences that seem harmless at the time. But I’ve set boundaries. Whatever I treat myself to during a shopping trip belongs to a predefined “freedom budget,” which keeps it manageable. The balance allows for small pleasures while maintaining my financial integrity.

Ready to Take Control of Your Budget?

If you’re tired of feeling trapped by your grocery expenses, take action and master your money management. Begin by adopting one new habit this week. Maybe it’s the list or turning grocery shopping into an adventure with a budget twist. Growth happens in the small steps we take.

I can reassure you that when I shifted my approach, the results weren’t just numbers on a piece of paper; they transformed my sense of confidence in money management. Now, I hope you can also make this shift and see your grocery bill begin to reflect the life you want to lead—one supported by thoughtful decisions, not mindless spending.