Imagine a world where wealth whispers instead of shouts. A realm devoid of flashy lifestyles, social media clout, and ostentatious displays. This is the exclusive universe of the silent billionaires, individuals whose hidden assets far exceed those listed on public rich lists. They operate with a level of discretion that many could only dream of. Their approach to wealth management is something I find utterly fascinating.

Highlights

- 🔍 Who Are the Silent Billionaires? Entrepreneurs and heirs valuing discretion over showmanship.

- 💰 How They See Money: Focused on preservation and growth rather than mere accumulation.

- 🏢 Where Do They Invest? From offshore funds to alternative assets that most don’t understand.

- 📊 Structuring Investments: Smart strategies that balance financial secrecy with robust governance.

- 🌍 What You Can Learn: Timeless principles of wealth that cut through trends and fads.

Who Are the Silent Billionaires?

The term “silent billionaires” refers to a group of individuals who have amassed significant wealth—either through entrepreneurship or inheritance—but choose to live under the radar. These people are rarely seen on platforms like Forbes lists or making viral videos on YouTube. Instead, they prioritize freedom, discretion, and strategic independence over public recognition.

I remember hearing about a well-known entrepreneur whose name you’d never find on a celebrity list—yet he privately funded groundbreaking sustainability projects worldwide. These billionaires are the unseen architects of global finance, making calculated decisions that resonate far beyond media glare.

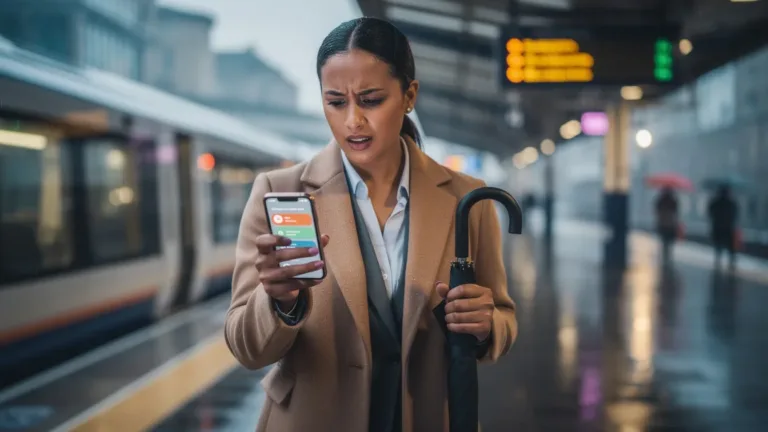

How They See Money

The mindset of silent billionaires is fascinating. They don’t chase more money for the sake of it; rather, they focus on preservation and multiplication of wealth. They anticipate crises and prepare accordingly, understanding that extraordinary gains without suitable asset protection are meaningless. The fear of lost wealth often drives conventional investors, causing them to make frantic, emotional decisions.

- 🔒 Prepare for the Next Crisis: Creating strategies that are resilient in times of uncertainty.

- 🛡️ Focus on Asset Protection: Always ensuring that what they have can withstand external pressures.

- 🤔 Avoid Emotional Investments: Insight over vanity ensures sustained growth.

Where Do They Invest?

Understanding where these billionaires invest gives us incredible insights into their broader strategies. Rather than chasing fleeting trends, they focus on assets with lasting value. Here’s a snapshot of their preferred investment areas:

- 🏝️ Structured Offshore Funds: They create diversified portfolios across jurisdictions using complex structures.

- 🏢 International REITs: These provide stable, passive income while shielding them from speculative losses.

- 🚀 Private Equity and Startups: Investing early in transformative companies for long-term returns.

- 🌍 Sovereign Credit Bonds: Allocations in strong currencies to safeguard against inflation and instability.

- 🎨 Art and Tangible Assets: Investments in global value objects that transcend the economic climate.

Structuring Their Investments

What truly sets silent billionaires apart is how they structure their wealth. They employ what I call tax intelligence, minimizing exposure while maximizing returns.

Many of them don’t just rely on conventional financial institutions but utilize services like family offices to ensure seamless management. Their focus extends beyond mere financial performance; there’s a strong emphasis on legacy-building and knowledge transfer to future generations.

What You Can Learn from Them

As I peel back the layers of their strategy, three key insights emerge that we can all leverage:

- 📈 Longevity Over Flash: The truly wealthy prioritize enduring strategies rather than chasing trends.

- 🔑 Discretion is Power: Keeping wealth out of the spotlight often leads to better outcomes.

- 🛠️ Structure Equals Freedom: A well-organized investment plan allows for greater flexibility and peace of mind.

In conclusion, silent billionaires are reshaping the landscape of wealth management in ways we might find surprising. Their approach teaches us that true wealth doesn’t seek validation from the world; it seeks to build something lasting. If you’re ready to explore paths less traveled and discover investments that last, stick with me as we dive deeper into this world.