Picture this: January 31st is creeping up on you, and you’re busy sorting out your life after the festive chaos. Meanwhile, your taxes are dangling over your head like a ticking time bomb. You might think, “Do I have to file a tax return when I owe no taxes?” Let me tell you, you’re not alone in this confusion.

Highlights

- 🧾 Filing obligations exist even if you owe no tax.

- 💸 Earning over £1,000 from non-PAYE work means you need to file.

- ⚖️ Ignoring your tax obligations can lead to hefty fines.

- 🤦♂️ Many low-income individuals face penalties due to lack of awareness.

Did you know? More than 600,000 people paid fines for late tax returns despite owing £0 in tax from 2018 to 2023!

Understanding Your Tax Filing Responsibilities

It’s tempting to assume the taxman only wants your attention when you owe him money. Incorrect! Even if your income strolls below the personal allowance of £12,570, you could still be obligated to file. What’s the catch? Well, if you’ve made more than £1,000 from any source beyond your regular PAYE job, it’s time to get that tax return sorted.

Take Mike, for example. He’s an avid blogger who started earning a few quid on the side. When he realised that his modest earnings crossed the £1,000 threshold, panic set in. He figured he had nothing to worry about since he owed no tax. Little did he know, that oversight could result in a £100 penalty. This is a crucial aspect of the UK tax system—the filing requirement doesn’t hinge solely on tax owed but also on income generated.

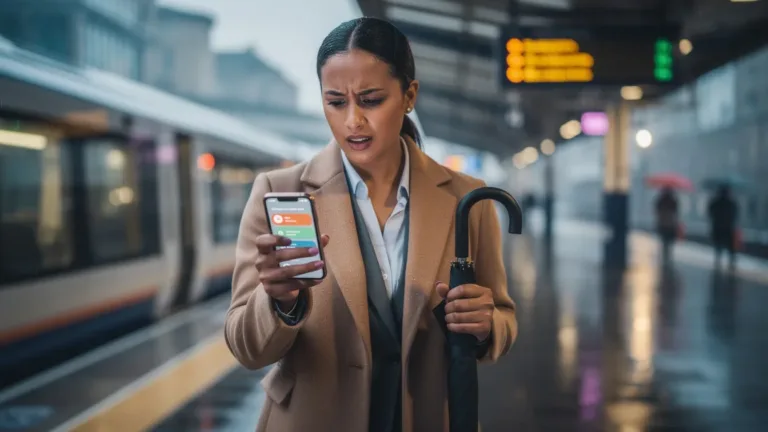

The Consequences of Ignoring Tax Returns

Now, here’s where it gets dicey. You might think that just glancing at your earnings and comparing them to the zero balance means you can skip filing entirely. Wrong! The temptation to let it slide can backfire spectacularly. Consider what happened to many unsuspecting individuals who ignored their filing deadlines. Besides having to navigate the administrative labyrinth of late fees, they ended up with fines that could amount to over £1,600!

Why does this happen? Because of the steep penalties attached to not filing. The initial fine starts at £100, and after a few months of delinquency, it climbs by £10 daily. Let’s do the math: that’s a maximum of £900 on top of the original fine if you forget for just three months! So, what may seem trivial today could become a financial burden in mere months, particularly for the vulnerable members of society.

Maximizing Tax Benefits

Here’s the silver lining: keeping a steady eye on your taxes can also open doors for certain tax benefits and exemptions. For instance, not filing doesn’t just mean you lose the chance to claim refunds you might be eligible for. Did you know many low-income taxpayers miss out on the Earned Income Tax Credit simply due to not filing? It’s like leaving money on the table, and it really can add up!

Whether you’re expecting a refund or hoping for tax credits, every penny counts. The incentive is undeniable; filing can be advantageous even when one believes they owe nothing. So instead of worrying about having to pay, think of the potential financial boosts that can emerge just by fulfilling your tax obligations.

What to Do if You’re Unsure

Still feeling lost? Don’t worry; you’re not alone. HMRC offers an online portal that assists you in determining if you’re required to file a tax return. Plus, for those who might’ve been self-employed in the past but are now employed, it’s essential to notify HMRC that you no longer need to file. Trust me; you don’t want to end up piled under fines because you simply forgot.

A little proactive care can save you from future headaches. The tax filing deadlines don’t wait for anyone, and they’re always lurking around the corner. Rather than wait until the last minute, set reminders—to give yourself ample time to gather your documents, fix any discrepancies, and complete that tax return on time.

Keep Calm and File On

As we near the end of January, let’s make a commitment to staying informed about our tax filing responsibilities. It’s easy to brush aside the thought of filing when you believe you owe no taxes, but ignorance can be costly. Instead, treat this tax season as an opportunity. Open your mind to the potential benefits of filing, and seize the chance for a worry-free financial future.

Ultimately, being ahead of your tax game isn’t just about responsibility; it opens up possibilities and prepares you for whatever comes next. So let’s kick off the new year with clarity and confidence—because when it comes to taxes, knowledge isn’t just power; it’s your best defence against unnecessary stress.